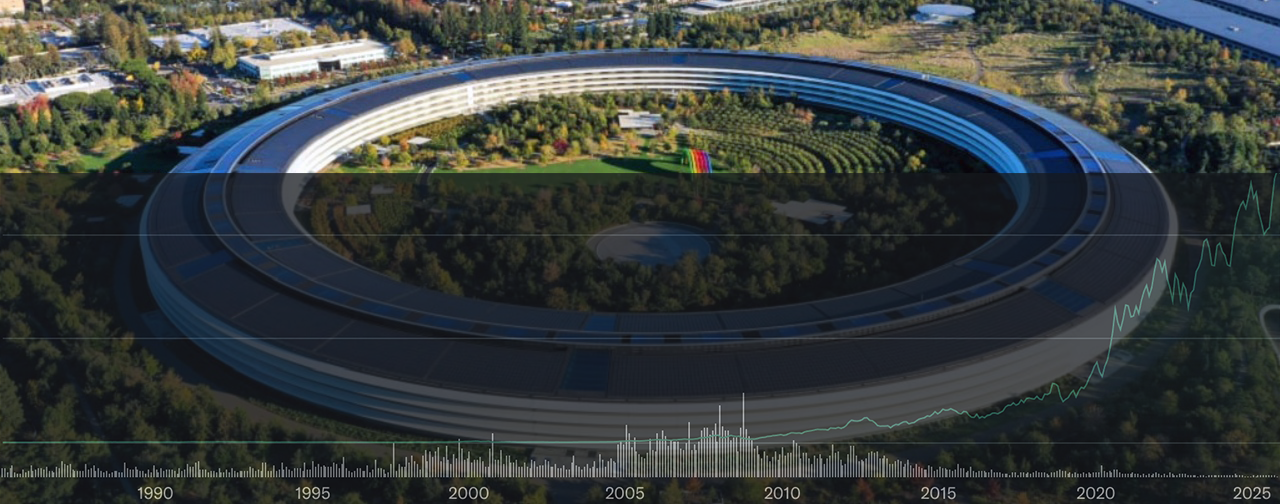

Apple Pay went live yesterday (October 20th). None of my credit cards (Visa and MasterCard) work yet since none of the issuers are with the initial participating banks (which is initially a very small list).

I previously had cards directly issued by Capital One, Chase, and Citi but closed those accounts years ago when I did a massive consolidation to get rid of all these accounts that I wasn’t using. I do have an Amazon issued Chase Visa but that one does not work with Apple Pay, a MasterCard issued by a local bank, several store Visa cards, a Barclaycard Visa (one of the companies shooting for an Apple Pay rollout later this year), my last Japanese Visa card (that hasn’t expired yet), and a Discover card (they also have plans to work with Apple Pay).

And that is why I mentioned before that Apple Pay is going to be a longer term thing; some institutions will move faster than others; some issuers may end up not even deciding to participate. The ones who decide not to participate will just lose some of our business though as I’m not going to wait that long to have at least one usable card in my Passbook.

Amazon for example cannot get their answers straight all on one single page. Some support agents are saying the issue is with Chase, while Chase is saying the issue is with Amazon. Note again that Chase is a launch partner (thus most Chase Visa cards are supported) so this all falls on Amazon. What’s known is that store cards including branded ones like Amazon’s Chase, are supposed to roll out at some later date.

Amazon corporate rather than being vague, should provide an official statement if Amazon branded cards will therefore eventually work with Apple Pay. Simple. If they are trying to beat around the bush though because they aren’t sure they want to support a competitors payments setup (since they are purported to also be working on their own payments system which would end up being in competition with Apple Pay), then they should come out with a statement now they have no intention to support Apple Pay on their branded cards (like how Walmart and BestBuy made it clear they are opting out of Apple Pay). Again, simple.

Without clearer communication, folks like myself are just going to presume Amazon’s Chase Visa cards won’t work with Apple Pay and just make the decision now to use some other card. I’ve already deleted my Amazon Business card from Amazon’s (and Amazon Japan) own site as a payment method because I’m going to end up consolidating most of my cards again, for those that support Apple Pay. That’s going to be Amazon’s loss since they lose the benefit of lower/zero merchant fees associated with their branded card. It’s again their prerogative but at the same time, their decision does impact Chase at some level. Why? It’s Chase’s loss because they lose out on any merchant fees associated with the use of that card period (myself, while I pay off all my credit card balance – I use them for the convenience in what amounts to a short term advanced loan which I never have to pay interest on – not using my Chase Visa at all outside of Amazon means Chase loses business on those merchant fees). I don’t intend to actively use any card that isn’t Apple Pay compliant in the future.

As for what card I’ll use with online businesses that don’t support Apple Pay, I’ll probably single out one credit card to use at those places. So why don’t I just keep using my Amazon Chase card as a payment method for Amazon/Amazon Japan (since it offers cash back rewards)? Again, my intention is to only have cards that all support Apple Pay and settle for one or two that will be my primary cards while I use one other card (with a lower credit limit) for everything else. The point is that all of these cards, I’ll be able to use with Apple Pay if I choose to.

Apple will also be rolling out loyalty rewards programs which will offset some of the rewards/discounts I’d be giving up by moving away from branded cards that don’t jump on board. A potential example is Target’s Visa Redcard. It’s not clear yet if that card will eventually be Apple Pay compatible since all these large retailers with their own cards, prefer their customers to use them since they do not have to pay the merchant/network fees. As a result, they incentivize customers to use those cards by offering either cash back rewards or percentage discounts (in the Redcard case, it’s an immediate additional 5% once you swipe your card).

But these retailers also like to gather that bucket of information regarding exactly what you purchased. With Apple Pay, that information is no longer available to the merchant. That’s why some retailers are sort of hesitant to fully sign onboard. Interestingly enough though, Target’s online app will allow purchases via Apple Pay which kind of leads me to believe they will eventually have their Visa Redcard, Apple Pay ready in the future. As noted earlier, Walmart and BestBuy have made it clear they won’t as they are part of a network of retailers (Merchant Customer Exchange) that plans to roll out their own mobile payments system. Interestingly, Target is a part of that group but haven’t fully opted out since again, they are accepting Apple Pay at least for online purchases.

Finally, some card issuers may end up gaining customers in the process. Myself, I’ve pretty much shredded every single American Express mailing (probably those pre-approved applications/ones that offer a balance transfer incentive) since I really didn’t want one more card/account to deal with. That persistence may payoff if the next mailing I get promotes Apple Pay (I could just apply online but I want to see what kind of marketing they use for this). And the AMEX card would just end up supplanting the Amazon Chase Visa in the process.