And after all that (another quarter of misses, larger than expected loss, largest loss in 14 years, huge inventory write down of an already low margin smartphone, poor 4th quarter guidance), this overvalued pig is down only 8%?

And what of Amazon Web Services? Sure it’s revenue grew year-over-year but it has to contend with Microsoft’s Azure which Nadella is making a central hallmark of his cloud computing first priority.

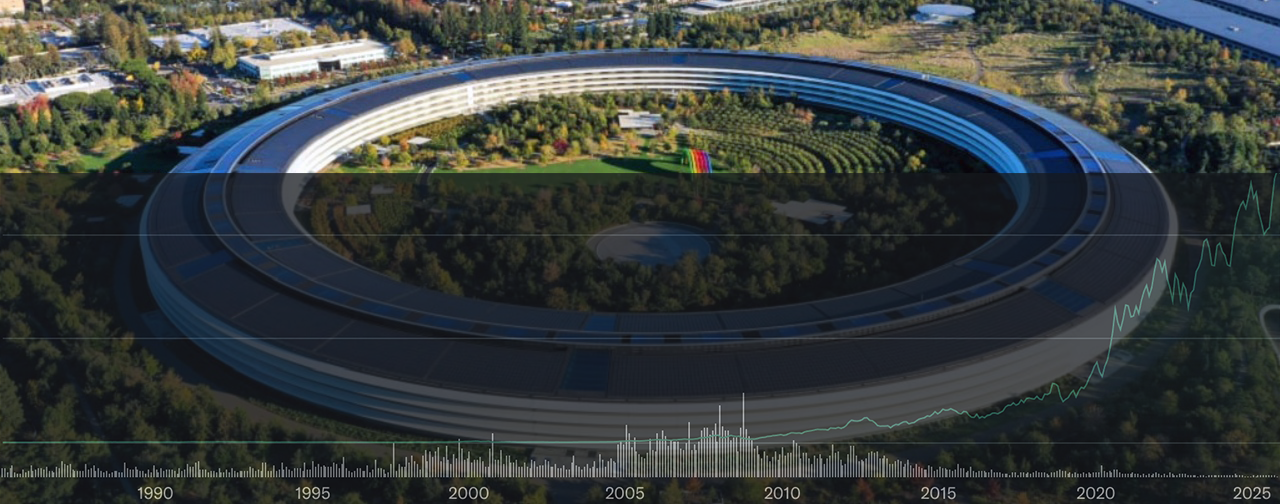

I still remember this September 2000 Apple earnings warning about lower than expected Power Mac G4 Cube sales which sent shares plunging nearly 50%. And AAPL’s valuation then was nowhere as ridiculous as AMZN’s which at even todays loss, represents a 700+ trailing P/E and 150+ forward P/E. AMZN is one stock that still has a lot of helium that needs to be let out…