Reminds me of the following:

The stock has a ludicrous P/E multiple of around 2,900 which really makes it one hell of an expensive stock. The company sells other peoples stuff at razor thin margins. They sell products like the Kindle at cost (or maybe even as a loss leader) as a portal to move merchandise. Revenue from Amazon Web Services (AWS) isn’t any where close enough to make up the low margins from their retail segment. They’ve been continually missing earnings for over a decade and/or posting losses.

As one of the few survivors from the dot com bust, how can Wall Street continue to give the company such a long leash?

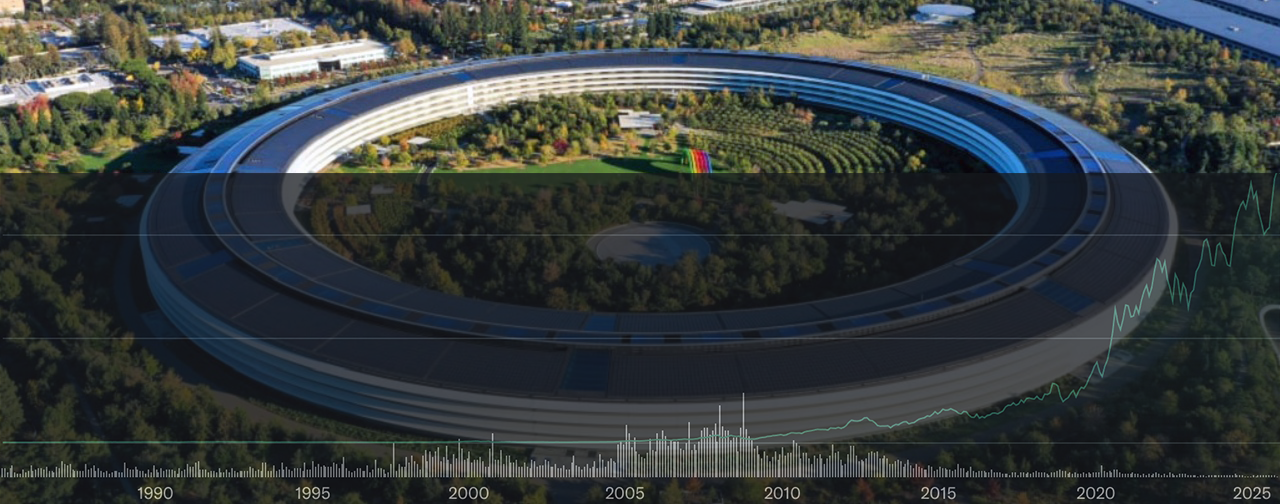

Contrast this with a company like Apple which designs its own products, has a vast portfolio of intellectual property, has double digit margins, and shows continued growth and profitability. It’s stock trades at a P/E of 13.5 which at it’s current $580 per share, is extremely cheap by comparison (even though AMZN’s share price is a little over half this amount at $234 at the time of this writing). One easy way to look at it is this: for every $1 of earnings, I’d pay $13.5 with Apple whereas I’d have to pay $2,900 for every $1 of Amazon’s earnings. At such a huge multiple, there is no way Amazon can generate that much net earnings over its lifetime to meet investors expected return.

Put into simpler terms, someone will eventually be left holding the bag when the bottom eventually falls out (it is not a matter of if but when that will finally happen).

As to how this stock can manage to defy all levels of rationality… I can’t help but to put on my tinfoil hat for a minute. Could it possibly have anything to do with the fact that CEO Jeff Bezos was once a hedge fund manager on Wall Street (at D.E. Shaw & Co.) and therefore, still has plenty of friends on the street in general?