Well this “news” was actually leaked and it should be interesting to see what transpires come Monday. This will be not so funny if they say “oops, this was a mistake”. Furthermore, this is like one of those “no shit Sherlock” and “someone has been asleep at the wheels” moments of stating the obvious for something which should have happened a long time ago.

With the average ordinary person, the phrase “living within your means” has real implications which becomes evident relatively quickly. One can only use whatever credit is available to them before they must pay it back with interest. And if your incoming cash flow can’t keep up with those payments, then eventually, you are going to start finding yourself in a situation where you can’t pay back those debts on time. Some also find themselves playing double jeopardy by using another credit card to pay off their bill for another. That circle doesn’t last long due to the interest charges involved and the resulting interest that piles up if you do not pay off the entire balance. The U.S. government likewise has been living beyond its means, spending far more than it makes due to years of fiscal irresponsibility. As a result, it has to borrow and likewise, has to pay it back. It is those residual payments that are growing and will continue to grow just like in the above example. But unlike the small time individual who will eventually have to declare bankruptcy to protect themselves from creditors, the U.S. has managed to find ways to avoid the inevitable of going bankrupt (though one could argue that from a moral perspective, the country bankrupt itself long while ago when it outsourced U.S. jobs out to other countries). True, a good portion of the spending (2/3rd’s of budget) that is involved surrounds programs such as Medicaid and unemployment insurance (though there is overhead for oversight of Medicare and Social Security, these are programs paid into by employees and employers via payroll deductions/employer contributions or for self-employed, via self-employment filings). Not many are advocates of cutting these because many truly do need these programs. Therefore, the issue of spending cuts is not a simple one but it also does not mean there aren’t solutions to other areas which can be cut (like say in defense spending; oh yes, I can hear the howls of derision in terms of putting the national security of the U.S. at risk; what I’m saying is there is much wasteful spending in that area which needs to be looked at closely but is naturally, not easy to do because it is about large sums of money going off to large numbers of contractors). Look at the overall size of government for example and ask yourself, does it really need to be as big as it is?

Rhetorical question… will this be the wake up call or will the U.S. government continue down the same path in terms of inefficiencies in the layers of bureaucracy within its organization? I’m keenly aware of the amounts of wasteful spending which goes on within the same organization (such as duplication of effort), poorly managed contracts (like say when multiple contracts are awarded for a major project and once completed, certain requirements are not met, resulting in a circular round of finger pointing as to which contractor/subcontractor is responsible which causes a domino effect for those who are supposed to be the recipients of that project; with one of the outcomes being wasted tax dollars as the issues are sorted out), inefficient processes (stuck in the old ways of doing things), etc. Naturally, this is not unique to the public sector as I’ve witnessed the same thing in the private sector. The one difference though is that in the private sector, the company has to eventually find a way to manage its costs/inefficiencies or face the inevitable of going out of business (and yes, I am simplifying things a bit for the sake of brevity). With governments though, crucial decisions tend to turn into a game of chicken due to the politics involved (witness how the clowns in Washington D.C. handled the recent debt ceiling issue for example). The “solutions” are usually always the same; cut spending (which usually means the above mentioned “entitlements” meant for the most needy people) and raising taxes (while there is always the rhetoric of having those who can most afford it pay their fair share, the reality is that the lower to middle class are the ones who get slammed the most from these increases) because there is a huge difference when you are making a five figure (in USD) yearly salary versus a six or higher figure amount. Note that this debt ceiling deal also does little to address the above mentioned issue (government spending more than it receives).

Spending cuts should be looked at first from within by cutting out the layers of organization and duplicative efforts; not an easy task when all too often, some of these bureaucracies are a direct result of decades of “I’ll scratch your back if you scratch mine” politics. Some government agencies are also top heavy or are generally far too large at the expense of other agencies which could use the manpower but are underfunded. Look at America’s crumbling physical infrastructure for example as an area which should have been properly maintained instead of letting it get to the state where it will cost far more to fix. For far too long, government lawmakers have not been held to any form of accountability with regards to how they are spending these tax generated revenues (pork barrel spending for pet projects is of course one of the knowns), and worst of all, put out the same B.S. political rhetoric every 4 years while getting the same amount of voters to re-elect them back into office such that they can continue their pilfering. Realistically, when the system is this broken, you would think the masses would wake up and not fall for the same hook, line, and sinker. My feeling is that one day (when it is too late of course), the politicians in D.C. and the respective 50 states will no longer be able to keep the lid on society. Note that politicians in other countries are not immune in terms of looking out for their own self-interests first and that of the citizens they represent next (look at the way bureaucrats in Japan handled the nuclear crisis for example where at one point, they were publicly bickering over the exact date of Prime Minister Kan’s resignation date while there were and still are, pressing matters). I’m not saying all politicians are like that but generally, the vast majority are a bunch of self-serving rhetoric spewing hypocrites whom I have little respect for.

I’m also fully aware of how the financial system is corrupt (the shenanigans of Wall Street are what led to the global financial crisis back in 2008) and how the governments Securities and Exchange Commission (S.E.C.) did little in terms of enforcement (and this shouldn’t be surprising when that organization has many former Wall Street insiders running it). But I’m also one of those who believe that you can only screw around for so long before the shit eventually hits the fan. This S&P downgrade of the countries credit is just the first leg of what will be a protracted downwards trend for the U.S. The political establishment lives and operates in their own ivory tower to be able to effectively figure out the means to downsize government to more realistic and manageable levels. Furthermore, trust for the financial markets is still in shambles after the shellacking many took after 2008 with their 401k’s. The next round of whipsaw volatility and market selloff isn’t going to do anything to change that already negative sentiment and perception. And if anyone hasn’t been paying attention, the world’s major currency reserve (the USD) has been taking a beating, and the faith in it has been on a downwards trajectory with money flowing into other safe haven’s like the Japanese yen or gold. Anyone who does not think this will then boil over to the global market is living in a dream land. The cost of borrowing money (interest rates) will go up to a point where global credit contracts resulting in yet another liquidity crisis which sends the global markets into turmoil again resulting in that whole domino effect of squeezing everything further down the chain (you know, like corporations, global spending, lowered tax revenues, real estate foreclosures, etc). My take is sometimes, you need a great big washout no matter how painful it is (which is why I was personally against TARP because sometimes, Darwinism needs to be allowed to run its course).

Which takes me off on a tangent for a bit. In college, a business major classmate of mine had a friend in California who already had a huge distrust of government including the future of the U.S. dollar and as a result, was purchasing significant amounts of gold in the form of bullion and old collectible gold coins. Myself, I wasn’t into any sort of that paranoia but also was mindful enough that some other country could eventually overtake the U.S. economy (and this was long before the trend of outsourcing our manufacturing base took hold) and that while the U.S. is the global leader, history has shown that what goes up has to eventually come down. Being a poor college student at the time, I scraped up enough cash to buy an initial 20 ounces of gold bullion coinage (American Eagles and Canadian Maple Leafs). The spot market price at the time was around $320 an ounce. After graduating college, I ended up collecting gold coinage with numismatic value (such as U.S. Liberty and Saint Gauden’s pieces) at just a few percentage points over the spot price throughout the 90’s when the price per ounce remained under $400. After 1997, most of my money went into the stock market. Back then, it never did cross my mind that gold would one day be at trading at $1600+ per ounce. Some of the mint state grade gold coins that I purchased for around $450 are now worth $1800+ per coin. Ridiculous… The weird thing about an asset like gold, especially if you take physical ownership of them (as there are some firms out there which buy on your behalf and store them; myself, I have possession of mine in a safe deposit box) is that the gains feel real (unlike the gains in a stock which only become realized once you sell them). Furthermore, the eroding value of the dollar (which is basically a worthless piece of paper known as fiat currency with only the trust of the U.S. government backing it unlike in the far past when gold and silver did back the actual paper certificate) makes this gold feel even more secure even though the total value of what I own is small in comparison to the paper gains that I have with AAPL. I’m in no way advocating anyone to go out and buy precious metals (that requires each persons own due diligence); all I’m saying is that my decision to physically own some gold has been a great hedge. Previously to collecting gold coinage, I was also collecting old Japanese and US coinage which of course, have actual silver content in them (in addition to their numismatic value). So it is safe to say that I least have some bartering insurance should the U.S. dollar really go kaput (not saying that it will; no one can deny its loss of buying power though).

Digressing, I know my crystal ball is defective but I fully expect my and everyone elses portfolios to once again take another round of beating (been there and done that too many times already). But as I’d previously mentioned when AAPL reached new all time highs, there would be opportunities for me to raise some cash and accumulate more. So I have stink bids in at $350 per share and lower where I can trade-in this constantly devaluing dollar in for something which will eventually make that dollar go a longer way. I personally have little faith in U.S. lawmakers actually fixing the problems at the root which means downsizing government and by this, I mean at the federal, state, and city level where more often than not, they are all bigger than they need to be (they are only large because of politics plus inefficiencies in the process and organization where all too often, there are artificial walls put in place between agencies which in reality, should be working far more closely and transparently with each other – without these walls, redundant efforts would be eliminated which results in cost savings). I’ve always felt that bandaid fixes will eventually fail and that the end result will be far more costlier to address in the future when such bandaid fixes are no longer effective in hiding just how big the problem is. But that is the sort of short term mentality which has been happening for awhile now not only in government but also in the financial sector. We ended up outsourcing our manufacturing to places like China for the sake of the almighty profit and revenue growth at all costs mentality. And part of that is because we at home did not properly invest in the education system to make sure we have the brain power and engineering talent to be a large pool of work talent for the operational side of the manufacturing business. And now we keep hearing the same rhetoric about creating good paying jobs for Americans. Riddle me this, but just exactly how are they going to accomplish this in an environment where one of the metrics of a publicly traded company is their overall bottomline? If expenses rise as a result of having to create these higher paying jobs (not only in wages but also associated benefits), what do you think is going to happen to that companies stock share price? See where the problem resides? Companies are caught between a rock and a hard place and it is not only about shareholder value. Many companies also offer compensation in the form of stock options which naturally means getting the price of those shares up over the long term in order for employees of the company to benefit. And all of this again does not address the inability to supply a large enough pool of talent to operate and work in such plants in the US. To put it simply, we cannot compete with Asia in this area. I mean, how many American’s would actually be willing to live in company supplied dorms on the premises?

Many years ago, I made the conscious decision to carry very little debt as I did not want to be a slave to work as being the means to constantly have to pay off such debt. I also made the decision that I cannot depend on the government when I retire (whatever I’ve paid into the social security fund, I expect to likely never see when I’m of age to be eligible to receive social security benefits). In other words, it’s a cognitive lifestyle change where I work to keep myself busy and use the funds to invest and hopefully get a decent return which outpaces inflation as well as the devaluation of the currency, while hopefully serving as a retirement nest egg. It also means I pay off everything that I buy even if I use a credit card (for convenience). I also often times take advantage of deferred payment deals (like BillMeLater and Amazon’s GE Money) out of reverse principle and always take great satisfaction when I send that full payment 2 full weeks prior to the end of the promotion knowing they are not getting any interest from me (thank you for the interest free loan). I also ignored the constantly promoted fallacies that we have to constantly spend in order to grow the economy (which also includes the constantly pushed propaganda of the American dream of owning ones own home which for most people, means taking on a 30+ year mortgage; and therefore means, becoming enslaved to that cycle of employment in order to pay for that mortgage). If I can’t afford it, I don’t buy it. Yet, that is what has been force fed to the American public where you should buy all of this junk even if you cannot afford it. Banks were providing loans without will really doing their homework on an individuals credit worthiness. That is what that sub-prime mess was all about where people were getting loans to buy homes which normally, they would not be eligible for. Where is the personal responsibility in all of this when even the government is involved? Everything was about credit, credit, credit.

The point I’m making is that through no real fault of the public, an air of entitlement has been created by the powers that be where people expect to be taken care of by the government when the going gets rough. It is sort of like the Japan disaster where people, instead of heeding the history and advice of their ancestors (as well as common sense which I know, is not very common at all), did not instinctively and quickly move to higher ground in anticipating a tsunami. Instead, we have government issued inundation maps and evacuation centers as well as warning systems to tell people what to do and many people paid with their lives as a result of placing all of their trust in the government. My take has always been to use my own brain and head inland and as high as possible and not to wait for an official evacuation notice even if it is a disruptive inconvenience. It’s called being safe than sorry. Digressing, the whole issue of “entitlements” was hoisted on to the public such that it is no surprise that most people in general do not take more of an active hands on role with their own finances including living within their means. If government were smaller and/or politicians weren’t so hellbent on their own “pork barrel” spending (and kickbacks), there would not be a need to tax the living crap out of its citizens. If people knew they had to be more responsible for their own well being due to this decrease in government provided services, then the money which we’d no longer be taxed on could be placed into savings or invested to serve as our rainy day fund. If people knew they bore personal responsibility, maybe more would be living within their means. This unfortunately is not the reality and convincing the general populace (and more so, the political circle) of such a dramatic paradigm shift will prove to be impossible. So is it any surprise that the country is reaping what it sows? And yes, the corporate overlords and politicians are in cahoots to milk that same working class out of what hard earned money they do earn.

The situation the U.S. finds itself in is not only a result of living beyond its means, but it is also due to financial greed which emphasized cost cuttings at all costs without fully taking into account the impact it would have on the skilled manufacturing base within the country. The meaning of “good paying job” is eventually going to lose its meaning because “good paying” will be relative to the erosion of the U.S. dollar along with inflation and the inevitability of tax increases which cuts into the buying power of the currency. At least for myself, the long term prospects do not look rosy by any sense of the imagination and that is coming from someone who tends to have a more optimistic outlook. As someone who tends towards the pragmatic, I know that problems which left unfixed, and are only touched up on the surface, eventually fail big time where any earlier cost savings are immediately negated by huge costs that are incurred to fix and then rebuild going forward. The illusion of safety in Japan’s nuclear industry was similar where there was this false facade built up. After March 11th, that facade fell big time and it was revealed just how unprepared those in charge were of handling a situation which had crossed their minds but thought realistically could never occur. Such arrogant assumptions are inexcusable as these individuals are complicit in their inaction. Likewise, the notion that the U.S. will remain the number 1 economy needs to be reconsidered because there will be a point in time where China could/will pass the U.S. economy (the IMF says by 2016) if the underlying problems are not addressed. Additionally, the U.S. dollar will at some point, lose its place as the world’s reserve currency. Simply put, what goes up has to come down. And unfortunately, the other saying that “the bigger they are, the harder they fall”, will also likely ring true. Maybe this ultimate humbling of what some others in the world perceive as American superiority arrogance (those who have lived abroad understand this as they get to witness how others view their home country from the outside) will wake people up that the politicians they’ve been electing into office were just a bunch of clowns, who sold out the future of the country for their own gain.

And finally, here is the real kicker and irony to all of this (the subject matter of this post). Rating firms like S&P are a wholesale part of the scam of what one can say has been a huge financial ponzi scheme meant to benefit insiders including those within the political ranks who had no problems selling their soul for a piece of the action. Watch the markets next week and see peoples positions get stopped out while the bandits once again fleece the shares of those who still don’t get what Wall Street is all about when it comes to their wash, rinse, and repeat cycle. Hell, the selloff in the S&P 500 over the course of this week before this came to light should have been a sign that someone already knew something (oh color me surprised that gasp, some folks already had inside info). While I feel for those who have been playing the highly leveraged game with options or trading stocks on margin, that is exactly what the street wants people to do because that is where they make their money when it comes to commissions, fees, worthless expiration of options, and market making shenanigans in terms of price matching (they make squat off of those like myself who buy and hold and have no stops set). And then those who are highly leveraged get whacked even more as they receive margin calls or due to fast moving market conditions, have some of their holdings automatically liquidated to cover those calls). Then we should expect to see a rally so as to continue the wash, rinse, and repeat cycle while the next wall of worry is established. Yes, eventually, there will be a day of reckoning where screwing around like this comes back to bite everyone in the ass big time which is my entire point about living within ones means. When the government has a big fat printing press to print fiat money and has little to back it up except with promises of their trustworthiness based upon credit rating agencies (whose own credibility and trustworthiness need to be questioned), what does that tell you? This whole notion of paying down this huge debt ($15 trillion and growing) is somewhat of a fairy tale only meant to give an illusion that the government is not just printing dollar bills with little intention of being accountable in some form since after all, what sort of signal does that send to the average joe like you and me who don’t have their own personal printing press where we can create our own bills to spend as we wish? (which of course, leads to a breakdown in social order and therefore, anarchy).

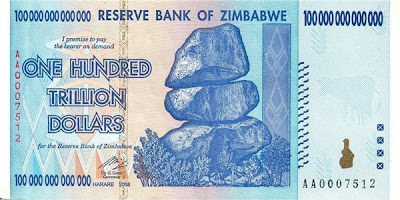

2 decades later, I have a far better understanding of what my college classmates friend was thinking when it came to his distrust and why he took responsibility for his own financial future as opposed to leaving that decision to someone else (especially relying on the government). And to end this extremely cynical post on a lighter note (pun intended), the following was making the rounds again. Search for Zimbabwe 100 trillion dollar bill to get the back story on this if you haven’t heard about it (the story is about the rampant inflation which once hit the country which required printing currency with a large amount of zeroes) to understand why current currency and the numbers printed on them are riding a very fine line of being meaningful and meaningless.

One Comment