This is one of those questions I occasionally get and is usually not something that is easy for me to answer without going into tangents. It’s been roughly around 10 years since I have been out of the labor force (doesn’t mean I haven’t done volunteer type of work over the years though). How this all came about also wasn’t fully related to F.I.R.E. (financial independence, retire early) either. It shared some similar objectives with “COAST F.I.R.E.” (more on that below), but one of the objectives was not really pursuing a course in extreme frugality (aka extreme savings). And this is tangent #1… like everything else, there is this fine balancing act. Extreme frugality can become habit forming where that habit becomes way too second nature later in life (where that habit is difficult to let go). Part of life (especially once you no longer need to be saving/cutting corners to extremes) also involves being able to enjoy the fruits of what you’ve earned. This is of course the exact opposite of those who have no fiscal constraint and spend everything. Neither extreme is good; the key is finding that balance (based on your personal situations). But I digress.

The “coast” aspect was something I picked up from one of the original Apple employees, Guy Kawasaki. He once said something to the effect that “if you do one thing right in your career, you can coast for a long time.” What exactly did he “do right”? He was the chief evangelizer of the Macintosh once it was released in 1984. His creative marketing style (utilizing a platform evangelizing approach) was one of the reasons the platform developed a rabid (and often times annoying) following. This “fanaticism” was something I didn’t really subscribe to as I was pretty much a Unix, CP/M, and DOS gearhead at the time.

Tangent #2; it wasn’t until 1991/1992 (can’t recall the exact year) when I really became acquainted with the Mac (while I was running a graphics/multimedia service bureau on the side of my regular job as a systems engineer at Sun) since its entire graphical approach made those sort of applications a natural fit, and external hardware like color scanners just worked. I was really sold when I saw Astarte Toast easily burning a CD-R on this Phillips CDD-522 (this was in the early days when creating CD-R’s was an arcane process on DOS based PC’s (required typing in these cryptic commands/info in the proper order; the Mac had a graphical program that removed all of that and made it a point-and-click process).

CD-R blanks cost around $7 each at the time (they were mainly used for creating the final pre-master that would be sent off to an actual CD manufacturer who would then create the actual “glass master” used for pressing actual CD’s in quantity runs) and one of the biggest problems on the PC side was buffer underruns (where the entire burning process would abort and you would end up with this expensive CD-R “coaster”). At that time, Toast sold for $900 while the 522 went for $4,999 (the price quickly dropped to $1,599 at which time I purchased it along with a copy of Toast and began doing a lot of CD+G for things like karaoke CD’s as well as general multimedia discs). Once actual desktop computer burners started showing signs of becoming more commonplace, I sold the entire business off to a full-service bureau. A portion of the funds from that were used for investing. But I digress (back to the portion regarding Guy Kawasaki again).

Kawasaki became “legendary” in that regard where he was able to live off of this reputation for the next several decades after leaving Apple. He continued working in the industry (entrepreneurship and later as a venture capitalist) and wrote well over 15 books. My idea of “coasting” was very much to not get into that cycle of trying to strike additional “gold” by jumping into other business ventures (thus not solely about “right career choices” but also right choices in other areas as well. My idea was to be able to make and invest enough where it was generating passive income (allowing that to compound over a timeframe where I could potentially exit the workforce completely by the time I was in my late 30’s). Self-inflicted wounds plus market conditions made me miss that mark where I ended up early retiring in my 40’s (still good all things considering).

An important part in all of this is that I had the benefit of being employed during that wonderful time of the earlier years in the tech industry (and thus had the additional benefit of employee stock options and other forms of compensation that greatly helped in accomplishing one of those financial goals I had set for myself while in college). As noted above, I also ran that graphics/multimedia company before selling it. Basically during and in the few years after college, I was the definition of workaholic/keeping way too busy delving in to many different things including various hobbies (my most costly one at the time was collecting coins/precious metals; previous to that, it was fixing cars). Nowadays, my guitars is what has been the most expensive hobby (but I’ve sold over half of them because they take up too much space). Once a collector, always a collector… But this is another side tangent…

Digressing (back to the original topic), during the tech/dot-com boom, I did partake in aggressive investing using savings + proceeds from the business sell which were all specifically categorized as funds that I was willing to lose in the process (taking the much needed lumps along the way as part of those life lessons that one needs to keep yourself grounded in reality). I had to also consciously compartmentalize all of that and treat it very separately (complacency is too easy a mindset to fall back into). My investing adventures was written from that mindset.

I’ve also had various side interests/opportunities (like audio engineering and having that opportunity to be part of the field testing for Yamaha’s then emerging digital mixing consoles) that I simply took a “YOLO” (you only live once) approach, which was aided by those business trips to Japan (as one of the Apple Enterprise/OS X Server folks who worked with the Apple Japan office in Tokyo). That provided one of those opportunities to actually be part of that rollout in the 2nd half of 2001. LIttle did I know at the time that I would leave the world of Silicon Valley and actually end up taking an opportunity that popped up in Japan a few years later (visiting via personal travel/business trips versus living/working there was an exciting next adventure to me), where it sort of was and wasn’t tech related (it was that period of time with the transition from analog to digital) where it turned into the “jack of all trades, master of none” sort of experiences that I’m still trying to find ways to piece together and properly put into words (much of this is now hitting the 20-25 years stage since it happened). And it’s a culmination of these actual experiences that helped to further refine the simpler goals I had set in college as a student as far as financial freedom (not having to rely on a private pension or government social safety net; where I could early retire and effectively coast).

As far as I’m concerned, everyones situation is different/unique to themselves, their own comfort levels, their own tolerances to risk, etc. It’s why I also never subscribed to any one system or considered buying that “experts” book about how they did it. Sometimes it is about being in the right place at the right time. The problem with that is most peoples brains break when a significant amount of wealth is suddenly thrust onto them. Many of these people turn into the worst caricatures in the process. It’s why there are these excessively wealthy “tech-bros” who wield a lot of influence, but at their core, aren’t really smarter/more visionary when you crack away at that facade. In recent years, there is a subset of these, the “crypto-bros” where the ones who made bank but aren’t necessarily smart/wise, will try and wield that wealth into power/influence (making some of the worst decisions in the process that impacts everyone else’ life in not better ways). I dunno; maybe if I had a different set of personality traits, I’d have become one of those types as well (wanting more money, power, influence, etc and living in that other bubble of reality). Coming from a non-wealthy (typical middle class) family background helped where you learn/appreciate the intrinsic value of money; I do also have to thank my parents (my late mom specifically) for giving me these grounded values.

To be more specific, I’m one who has long been grounded in reality and know I’m no genius. Hell, just maintaining a 3.0 GPA in school required me to study a lot. And doing well in investing was not because I was some brilliant investor. Lot of it came down to self-discipline and learning valuable lessons (when mistakes were made, the key point was learning why those failures happened and making sure not to repeat them again). Life itself is a constant learning process of trying different things, making mistakes, and trying to come out better. Money itself is a means to an end (there’s a point where extra digits on that account balance is excessive). You also end up learning what works and what doesn’t work for you as you go through this process. This is key as to why I don’t subscribe to the “one size fits all approach” when it comes to a topic like this.

Being grounded in reality also means trying to look at things from all sides. Taking this skeptical/contrarian/devils advocate approach especially in the realm of investing, has been probably one of the most helpful tools in this journey towards financial freedom. With regards to my blog postings, I often times dump out negative slanting ones in order to vent/rant (in verbose stream of conscious style) just to get that out of my system. We can’t ignore the negative stuff that happens around us (that just leads to blissful ignorance which doesn’t help with really valuing what those positive forces are in ones life). The key that I’ve found is acknowledging those negative aspects but not letting it consume your entire existence (but I am human and sometimes have to catch myself from falling into that cycle). Like one of the most valuable lessons I took away early on was having that “lousy” boss; the lesson for me was to never become like that (it’s why I have this propensity for occasionally writing about terrible corporate executives who have this propensity for making bad decisions that drives the company they are running into the ground).

A lot of this (my own unique personality quirks/eccentricities) is why I often time end up standing on that hill alone principles wise. I could’ve just remained in Silicon Valley, pursued that corporate executive ladder and all of that other stuff. Would I have been happy though? The answer for myself was always clear, nope. I cannot backstab/two-face others in the name of “corporate executive ladder climbing”. Maybe that wouldn’t have been the case at Apple during that time period, BUT understanding human nature, there would probably be someone else in the organization doing that to me (no thank you).

Similarly, when I observe a company/individual doing wrong, my tendency is to break association. It’s why I never invested in military defense stocks (because you are basically supporting the hardware that goes into direct or indirect/proxy wars). Similarly, I’ve stayed out of real estate (because that speculation is what has driven the cost of property upwards and reduced access to affordable housing for many). It’s why I divested from companies like Amazon, Facebook, and most recently Microsoft over the years. It’s why I ended up giving away most of the realized gains from those investments. And I’m sorry, but I dislike shysters like Robert Kiyosaki (a fellow Japanese American who has sadly chosen to rip others off for his own financial gain). Notice how these fraudsters like him always end up trying to sell you their “get rich quick” material. Yes, there is some good advice in them (normally the common sense stuff), but always a lot more that isn’t. This is one of the other reasons why I chose not to write any sort of book either (my experiences in this investing adventure were unique to my own personal views/quirks and like everything in this realm, past performance is not indicative of future results).

For many people, something like their personal finances is just that, PERSONAL. Managing those finances seems pretty straightforward on the surface. You earn money, you spend some of it to pay your necessities, you try and save what you can. For many, the savings part is easier said than done because the system is “rigged” against most from having a decent paying job to begin with. The part where things also aren’t as clear is how to make that savings work for you. I like to use my own parents as an example. Looking back, they weren’t saavy in that area. Their money went into traditional savings and retirement accounts. They weren’t even put into mutual funds (back in the 80’s, they lost out on the market gains at that time). Traditional savings (interest rates) aren’t going to really yield any returns over time that keeps up with and outpaces basic inflation for example. Similarly, the instruments within that retirement account can also be those low risk fixed interest rate funds that doesn’t grow that principle over time (to outpace inflation).

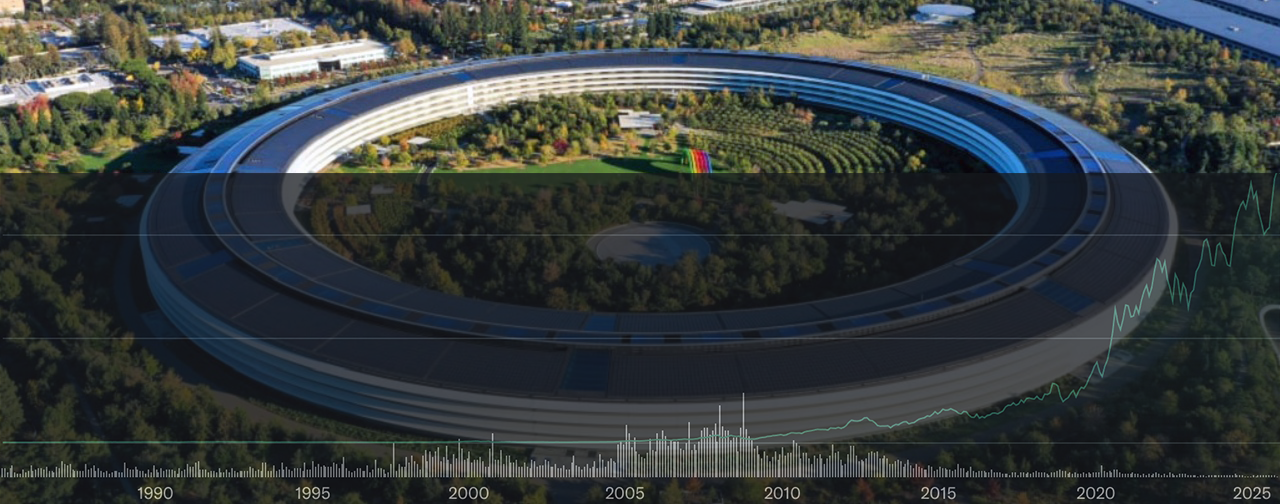

I had to eventually hard sell convince them (my father specifically) to roll over one of his old profit sharing plans into a brokerage account, and invest the whole thing into Apple back in 2007 (post iPhone announcement). He did not want to invest the entire $30K though and instead was ok with $10K (which was better than nothing). I said there was the good potential that it would at least double within 10 years. On a pre split-adjusted basis (AAPL had a 7-for-1 split in June 2014 and a 4-for-1 split in August 2020), AAPL was trading at around $84/share back then which meant he purchased around 120 shares. Accounting for these stock splits, that is now 3,360 shares (that were purchased at a post-split adjusted cost basis of $3.03/share) at todays market price of $213/share, it’s now worth $715,680. If he had followed my original advice (the entire $30K), he would have 9,996 shares that would be worth $2,129,148 at todays $213/share price. This was one of those really rare opportunities to proverbially “back up the truck and to load it up”. I created an entirely new position (separate from the shares I already owned from prior purchases plus the vested employee stock options from my compensation and “loaded up the truck”; multiple decisions that proved to be the right ones that has allowed me that opportunity to coast for the past decade. Apple also began paying out dividends again in 2012… aka passive income where that money has been working for me for the decade since I early retired.

I don’t have a crystal ball. I’m no genius about this stuff. It was just due diligence, intuition (that the product called the iPhone was simply a portable handheld touch-based computer that also had telephony capabilities and was marketed as a smart phone) and looking for the potential return if the company executed on what was then, a low ball goal (IIRC, the company had project a 1% market share of the smart phone market in the first year). I made decisions that turned out to work out (and it could have turned out differently). You have to remember, many were lampooning that initial iteration because it lacked a physical keyboard, was only 2G EDGE on AT&T, and its $499 price with a subsidized contract was laughed off as too costly (Steve Ballmer who was CEO of Microsoft at the time, made the following comment – ouch).

If it weren’t for this braindead take and the company decisions that followed (their Zune and Windows Mobile product strategies), Microsoft could’ve stood a good chance at being the one to go head-to-head with Google’s Android in the mobile market where things would be very different today for Apple (less of the juggernaut it became) as well as the smartphone market/ecosystem. Finally, Apple executives who continued to pressure Jobs (after the original iPhone launched) to allow the iPhone to have native apps (serviced via an app store), was what really helped to propel the platform; the rest is pretty much history.

I still remember how slow the uptake was in Japan for the iPhone for the first few years. Flip style keitai with a physical keypad were still popular because T9 entry for kana input was second nature (along with that muscle memory and tactile feedback). It really until after the iPhone 4S (2011/2012 timeframe) along with the abundance of Japanese apps that finally drove broader adoption (along with a usable mobile internet versus that now archaic mobile WAP system that was being used). Just having transportation route finder apps like Jorudan or HyperDia along with usable GPS maps really changed things (along with the myriad of mindless games that one could play while taking that train).

And this brings us to the present (and unknown future); what “thing” will be the next big thing? I’m going to go into a few more tangents here… Now that we are halfway through the 2020’s, this market is now very mature/saturated (with foldables being the thing on the high end) while Apple’s ecosystem is being challenged legally by governments who want to force it open. It’s almost humorous how clueless lawmakers are when it comes to platforms and their respective ecosystems. Using their logic, they should also be forcing the game industry to make sure those titles and those ecosystems are openly available across Linux, Mac, Windows, PlayStation, Xbox, and Nintendo Switch.

Not even I believe in that since the console market is its own thing while the consumers in the desktop gaming market have also decided where that development is being prioritized (long dominated by Windows); the Mac has never been a good platform for games because of conscious design decisions (hardware and going their own way on the graphics API side including having an outdated version of OpenGL which was the main API that offered some base cross platform compatibility for developers before releasing their (Apple’s) own initially incomplete Metal API and depreciating OpenGL completely).

The iPhone (iOS) platform is just that with its own ecosystem. It competes openly with Google’s Android (which a multitude of other companies utilize to sell their own hardware and may have their own small ecosystem along with the larger Android one). Many of us chose this walled-off-garden approach that Apple decided on if it meant increased privacy and security (note there is still a lot of garbage on the app store that makes it past their screening process). I also do get why many larger developers now balk at the 30% Apple takes and I do agree they should be allowed to offer purchases from their own store front as an option. The original app store was a means to an end at the beginning where no one would have to create and host their own online store (Apple would foot the bulk of that work in exchange for that 30% take).

Over time though, I believe that there should’ve been a scale attached to that (meeting certain sales volume metrics would bring that fee down). The app store is still great for smaller developers who don’t have to roll/support their own commerce solution. But if a company spent the resources to create their own (as Epic has done), they should’ve been able to have that option early on (versus having to had this litigated in the courts). Does Epic’s CEO Tim Sweeney protest too much? Yeah, he is over the top at times (same with the Spotify CEO) where if they think they can do it all better, they should just pull their apps off Apple’s app stores completely and do everything themselves. But I digress on this section of tangents… 😛

While Microsoft is currently “on fire” with their AI initiatives (which is what Wall Street has been pumping), I personally believe (and I maybe very wrong) that this AI bubble will burst soon. It just looks unsustainable (the pricing structure many of these companies are putting out offers insights into what all of that data center build out and the requirements to power all of that is really costing them). Plus most of the hedging into this area occurred at least a decade ago (where the smart money is going to be discreetly exiting in order to lock in those gains). In short, AI would’ve been a similar COAST F.I.R.E. play with incredible ROI if one loaded up the truck in the latter half of the previous decade (some of it back then was marketed by its original name, neural networking where even IBM (which has been another long term core holding primarily as a dividend stock) was doing a lot of research in this area since the 1950’s at its Watson Research Center (the real time translation stuff interested me a lot).

I’m in no way recommending IBM now either. While the company has continually transformed itself over decades (their focus now is cloud computing, AI including technology research, consulting, software). They were once the computer industry behemoth which has now been dwarfed by Apple and Microsoft (IBM’s current day market capitalization as of todays market close is around $235 billion versus Apple’s $3.1 trillion and Microsoft’s $3.9 trillion market caps). This was after IBM sold off their lower margin units including their personal computer hardware business (to Lenovo) and later spinning off their enterprise services division into a new company (Kyndryl Holding); I still have those shares of KD as I am undecided on them. IBM’s mainframe business (hardware) has seen a resurgence with AI. Their mainframes/minis are still mission critical and used in banking/financial and other sectors. But that stuff isn’t sexy/hype worthy for this Wall Street pump and dump routine (or I would put this more like IBM has long been viewed as this business of “suits”; reliable but hard to get the investment crowd hyped up about).

The point is that I have no idea where the “puck” is already heading towards where that “new” thing of today (or maybe one of those being researched for decades) is what will pay off those huge dividends a decade from now. Some folks are suggesting quantum computing (another area that companies like IBM have long been doing research in) or superconductor technology (which would add another breakthrough for computing tech). Optical interconnects at the chip level is another area that could offer that tech breakthrough but I have no crystal ball in any of this (and I am no longer having to perform a lot of my own research/due diligence since I no longer have any interest in investing since what I have is already working for me).