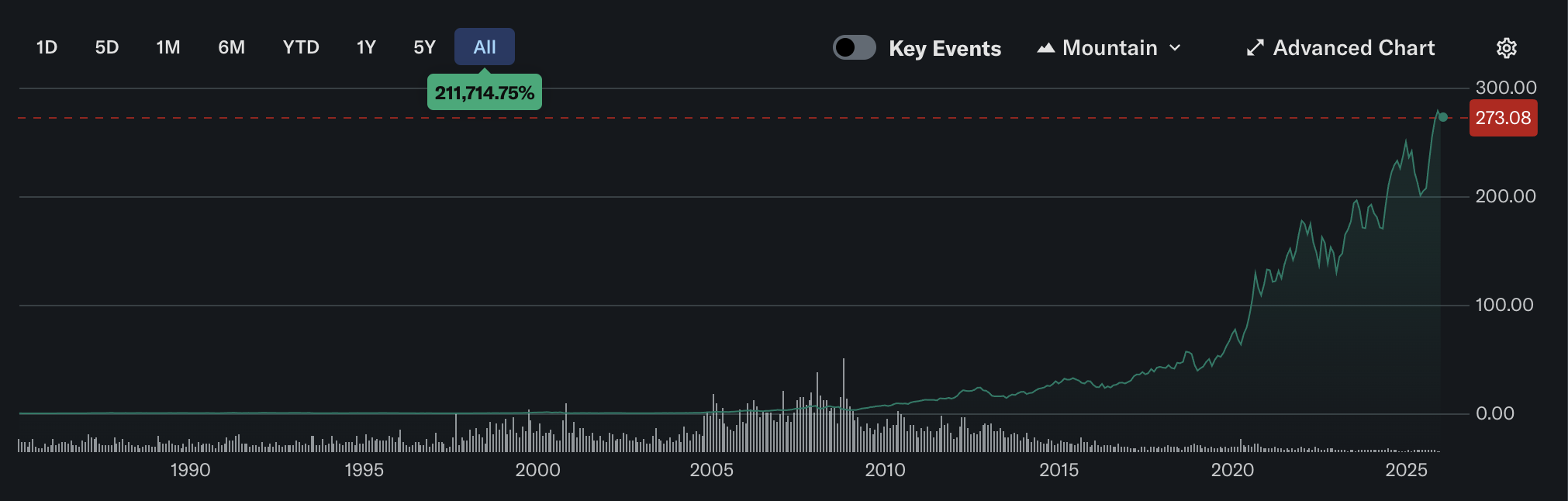

Back in late October, I made that post. During early December, it was pushing close to $285/share (where it seemed like it had a chance of getting to my sell price) before pulling back into the $270-275/share trading range on broader market sentiment for the remainder of the month. Thus those market limit sell orders were all set to expire on the final trading day of 2025.

In the past, I would’ve just waited for the next opportunity (which in the case of selling, has been a much rarer thing since for the longest time, it was about letting that cash work for me). But since this aspect (to begin the process of locking in those unrealized gains starting in 2025) has long been part of a planned exit strategy (further fueled by what I wrote about in that other linked posting in the above), I changed those orders an hour before the market closed on December 31st to market sells and they executed at around $272 and change.

There is a point in all of this where trying to maximize every percentage point of gain isn’t “worth” it when one has a sufficient quantity of shares to divest out of (nor need every single “penny” from it). The other point is at this stage in my life, I need to start using part of this (no, I am also not going to waste funds on something like this either).

Also as noted in this other post, a good percentage of the proceeds from this initial divestment is going straight into an already long established legal fund (this is to deal with those individuals who enjoy playing stupid games in order to win stupid prizes on platforms like that if they decide to get me and/or the channels I volunteer for, involved in their dumb dramas).

2 Comments

Comments are closed.