https://finance.yahoo.com/news/bitcoin-plunges-below-88-000-005308026.html

I write “only” because that is based on just the recent sell-off in various crypto issues that are sold in the equity markets. The dot.com bubble was similarly built on very highly leveraged positions which deflated in a chain reaction when margin calls hit those automatic triggers. Back then, algorithmic trading (high frequency trading) was in its infancy; now, a lot of market moves are no longer based on fundamentals because computerized trading just moves the market and generates trading profits out of those moves for the biggest traders. Wall Streets cottage industry of analysts (and people employed to run these financial “news” sites) are just there for this rollercoaster ride.

The reason why I link often to Yahoo Finance is that it’s no longer a monolithic entity. It has long transformed into a financial news aggregator of articles, news, and reports from a variety of sources where it is easy to see the dichotomy and contradictions with the ones doing the hyping (pump & dump) versus the ones trying to report the reality.

The dot.com bubble is that smaller peak back in 1999-2000. The NASDAQ composite itself has most of these tech companies where the current AI and crypto bubble exists where the entire reality of actual fundamentals no longer exists when taking into account these global tariffs that are being unilaterally (and often times unlawful) pushed by that orange colored criminal running the US. This recent selloff is miniscule when considering it is only slightly off its recent all-time high of 24,019.99 (the percentage difference is what matters).

And now, you have analysts and business leaders alike (including one of the beneficiaries of this AI bubble, Jensen Huang of NVIDIA), saying there is nothing to see here; that it’s not an AI bubble. And let me tell you, this is like snake oil salesman BS with selling hype to the next “greater fool” that decides to “buy those shares of the smart money that is selling to lock in their profits”; especially when you start unpacking the highly leveraged positions that could create that scenario where the automatic circuit breakers kick in on a broader market sell off. This recent $1 Billion sell off is a blip when you consider the trillions in market capitalization that is built on these highly leveraged positions.

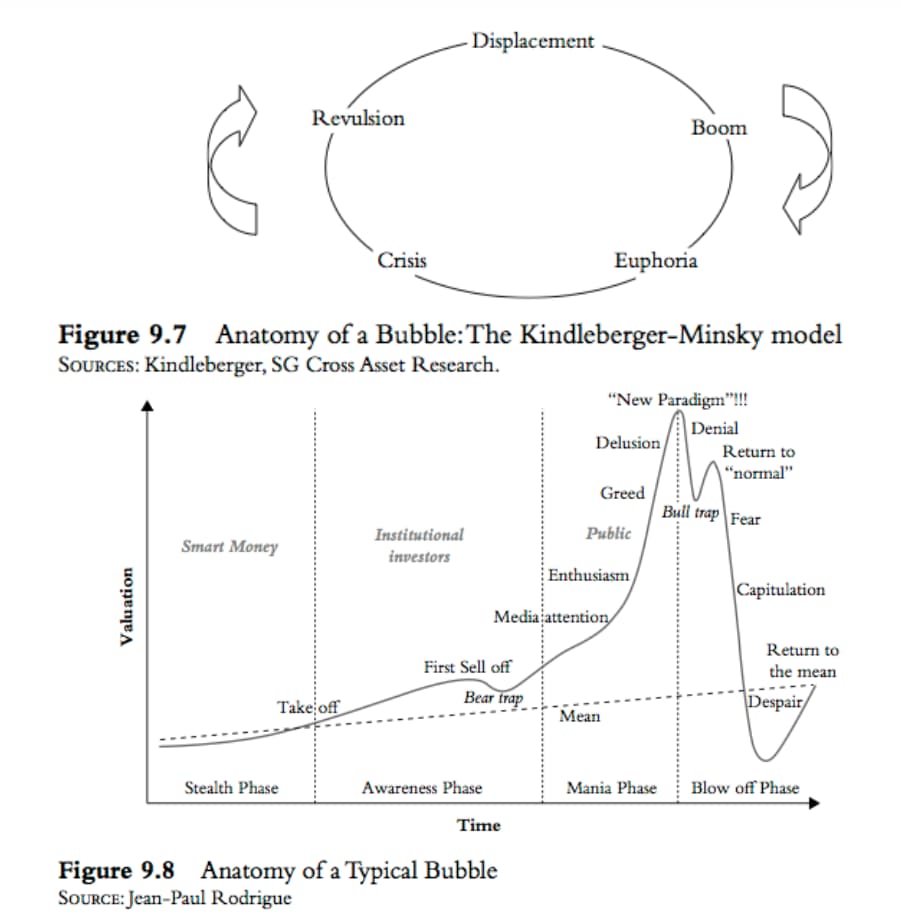

Bitcoin (one of the decentralized currencies that was meant to work outside of the reach of governments/their respective central banks), hasn’t really fulfilled its key role as that replacement decentralized currency. Anyone should know that when fiat currencies like the USD, JPY, EURO, etc are still what is being used globally for transactions. We were supposed to be able to use digital currencies like BTC to pay for all of our goods and services by now (based on all of the hype that was propagated a decade ago). The start of this current bubble began around a decade ago; see how this cycle of pump and dump works (more so now when computerized trading algorithms are driving the speed of this in conjunction with social media algorithms that have many shooting first, and asking the difficult questions later (or never at all).

Today, Bitcoin is not used for most any B2B and consumer transactions (it is arbitraged against a fiat currency like the USD as an example). What it mainly represents is a digital token that you hope you can find someone to pay you more for it than you did (aka “the greater fool” theory). It’s a digital version that isn’t any better than existing fiat currencies which its promoters (mostly these dumb folks that made huge sums of money early on, trying very hard to convince everyone else that this is real and as being better. Just as global fiat currencies are no longer backed by a physical asset like gold (instead, they are based on those countries GDP and therefore backed by the governments promise; though we know how that also goes when criminal politicians end up in positions of power where they end up finding ways to pillage and loot those coffers to enrich themselves), these digital currencies have nothing backing them and are virtually unregulated (but you have tech bros and other unsavory characters pumping them up to be this great thing).

The irony in all of this is also staring people right in the face; an issue like BTC is reflected in USD in the equity markets (purchased and redeemed with that USD currency which the crypto folks constantly want to eliminate with all other government fiat currencies). It’s comical how much pretzel twisting is involved when it comes to the logic behind this scam (and part of this was broken down when one of the things being used for blockchain technology was the promotion of digital artwork via NFT’s where the gaming industry was trying to jump on that bandwagon (but here were are a few years later with all of the hype about that blowing up into pieces as expected). Sure, the first movers made a ton of money (it’s how these scams work) but the suckers who came after, were the ones left holding an empty sack of nothing but false promises. And here we are again with a convergence of two overhyped industries and a far larger bubble that some (like Huang) are saying it is not (he has a self-interest in all of this of course).

Back in 1999-2000, the bubble bursting was a day of panic selling and margin calls (with the likes of CNBC adding fuel to that fire by how their hosts were covering it). It looked and felt like doomsday. What looked like a gigantic peak on the chart back then pales in comparison to this current one which began its ascendancy a decade ago. I’ve personally divested out of most of my long term positions and have only Apple (AAPL), Broadcom (AVGO), and IBM as my largest remaining positions (and the former, I’m already beginning to execute that planned divestment strategy). As I wrote in that posting, I have no idea if $300/share will be reached by the end of this year for that initial group of sales (but it’s one of the few bucking the current sell off because it is no surprising capital inflow will go into it based on their recent earnings).

As for those stories about an incoming reset being done to people’s money? Well, these often times hucksters pushing crypto and AI as the future, don’t have most peoples actual interests on their radar (because they want unregulated crypto to supplant the usual monetary systems so that they can do their criminal activity without any accountability). And it is no secret these folks want the USD devalued in order to create that instability, where these shady folks can promote digital currencies as THE REPLACEMENT (the ones who have long had positions staked out/their hands deep in the pot such that they will be the beneficiaries of such a move).

The biggest problem is actually trying to decouple global systems from existing currencies because of the chaos it would cause economically. Remember, these peoples wealth are also tied to things like the USD. Global equity markets are tied to their nations currency. But this is what happens when idiots have a bag of gold dropped on their head (by their lucky bets) and then try to use their wealth and influence that came with that, to push their often times bad takes on everyone else. Again, it is almost hilarious how these folks are willing to shoot themselves in the foot just to be able to have it all.