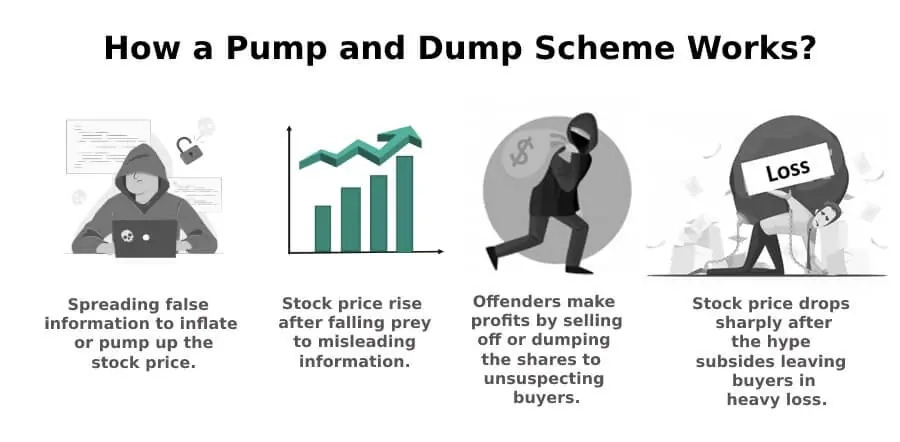

How about more like the old “pump and dump” game that the street (and various individuals like politicians) play? Nowadays, it doesn’t even have to be false or misleading information either. It can be like this; tariff threats and then potential talks/negotiations regarding those tariffs or delaying them.

https://finance.yahoo.com/news/wall-street-epic-comeback-unsolved-203123157.html

What it is not is an “epic” comeback nor is it an “unsolved market mystery” when this BS has happened before (or do we want to conveniently forget about history as we humans always tend to do) . It’s just short term market volatility which presents these trading opportunities (played long, short, and via the options market) meant for the big players. Back in 2011, I wrote this long winded opinionated rant (where good portions of it are still relevant in 2025). The second-to-the-last paragraph is a short summation of the current market dynamic where the financial “news” media is presenting it in this “epic” comeback manner when in reality, all of this volatility has not been put through the usual technicals which the market always ends up being subjected to. Translation, it’s the usual shenanigans of “pumping and dumping”, and repeating that cycle.

Market action again is now driven by computerized algorithms (high frequency trading) which had made Wall Street even more of a rigged game that those with huge amounts of capital, can generate large sums of wealth via that market volatility. These have been juiced up in recent years by machine learning (what others call artificial “intelligence”) where it can make those decisions (what is good or bad news) even quicker than before. People wonder why I am not enamored with all of this AI propaganda being perpetrated by the tech broligarchs.

Again, I am not against ethical uses of machine learning algorithms. But the bulk of it is based on ulterior motives (to feed people propaganda, to extract as much personal information from you without any regard for your personal rights and privacy), and utilizing a lot of outright intellectual property theft. Going on a short tangent, OpenAI wants to freakin monetize the crap out of ChatGPT (garbage in garbage out technology) while failing to get permission or even compensating people for all of the gratuitous model training they’ve done on copyrighted information (I have a problem with the corporate hypocrisy of “do as I say, not as I do” because it is pure unadulterated bullshit).

I’m pretty much in the Miyazaki Hayao camp (what he mentioned years ago in 2016 about the tech) let alone if OpenAI trained their models against Studio Ghibli art (and if so, “if” they got the proper permissions and licensing – we know the realistic answers to this). While this “Ghiblification” is fun, AI generated work is far from the “imitation is a form of flattery” argument especially if those models were trained from actual Ghibli artwork (and without the proper permissions and licensing per copyright law). Again, there is a monetization aspect to it (since the free version limits the amount of image generation per day; which can be gotten around with a paid version). I will call it what it is; IP theft (and thus want no part of it). Meta and Google do the exact same thing (this is why I made it a priority to reduce my footprint with Google properties and transitioning off of Blogger). And we are not even talking about the huge amounts of energy that has been consumed in the process. But I digress…

Again, this short TED Talk is required viewing. In the case of Wall Street, computerized (high frequency) trading algorithms have long preceded these other uses in order to generate obsene sums of wealth for those that have a lot of zeroes following the first number in their investment accounts.