I woke up this morning and expected to see a market bloodwatch. Instead, I saw my portfolios down by less than 2%.

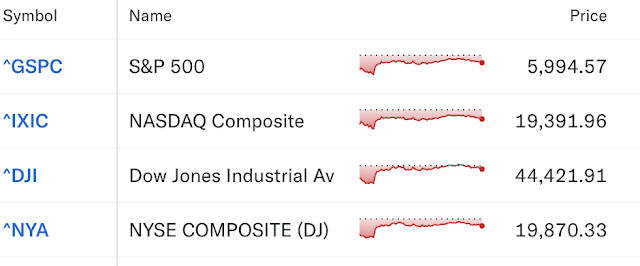

I then saw the news about the “last minute” deal between Canada and Mexico averting this trade war by delaying the tariffs for 30 days. China tariffs are still slated to go into effect on Tuesday BUT talks are supposed to happen (this may change as well). Thus in hindsight, part of this was performative (which angered a lot of people in the process, and will repeat itself again in 30 days). Yes, the market was down earlier before this announcement was made (looking at the graph, you can see where the major indices were trending down, and then popped on the news).

Anyone who sold, had stop losses and/or were playing the market/individual stocks short (and were forced to cover), got wringed out of the market (again). By the end of the trading day, my portfolios finished up by 1%. It’s the same old pump and dump drill (it just happens faster with computerized trading). Stop losses make sense in the old fashion market (where order flow was handled by actual human market makers (aka market manipulators). At a very overly simplified view, they would match make (in batches) the buyers and sellers.

Additionally, real time level 3 quotes would also show stop losses. Before discount brokers and computerized trading, real time quotes were for professional traders (everyone else got market quotes 15 minutes later – yes, rigged game). And when internet discount brokers became a thing, level 1 real time quotes was still an extra cost feature (over time, it became freely available while level 2/3 were paid for extras). Aggregating stop loss data allows a picture into where support exists for a stock. Professionals and institutional traders/investors used this to their advantage, often times “taking out” those positions during periods of strong market volatility.

With computerize algorithms, it can move the bid/ask very rapidly. The bid of course represents the highest amount a buyer will pay for a stock while the ask is the lowest price a seller will accept. The difference between the two is known as the spread. Computerized trading allows the match making process to occur quickly. That spread is also where money is made in the market while trading. And that amount while small on a percentage basis, is made up when considering the volume of shares being transacted. This is one of the dirty little secrets of the stock market (because a lot of money is generated here).

Additionally, the obvious intention (when investing/trading) is to buy low and sell high. “Taking out” support positions (these stop losses), allows market watchers to set the market sentiment (because often times, people make their decisions on emotion). There is this whole realm of “technical trading” where traders and investors look for these various signs of support and trends (like moving day averages) to make decisions (or recommendations) on when to buy/sell. I switched to long term buy/hold years ago (after resuming investing in the second half of the 2000’s) to basically not have to deal with the above (and therefore, didn’t have to be overtly concerned about what the impact would be from the tariffs; in todays case, I slept through most ot it).

On Wall Street, insider trading is illegal (when using insider information/knowledge to buy/sell stock). In government (when politicians are allowed to own stocks), they often times make trades based upon material information they are often times privy to. In the US, the STOCK Act of 2012 prevents Congress members from trading on such information, but they do it all the time (and aren’t held to account). Members of both parties engage in this which is why the public remains cynical of politicians. For this tariff news, it was probably insider information for #Felon47’s associates which allowed them to profit off of todays market action.

Separately, this whole ploy also sets the narrative that heavy handed bullying tactics like this work whereas the reality is far from that (since the concessions were things already negotiated during the Biden administration; thus the performative part in all of this since it makes it look like the heavy handed tactic worked to even get these already negotiated concessions). For both Canada and Mexico’s leaders, it gives a 30 day reprieve on the entire thing.